The Strategy That Finally Made Me Respect Risk Management

I’ll admit: early on, I ignored risk management. I thought “I just need the right trade, and I’ll win.”

I’ll admit: early on, I ignored risk management. I thought “I just need the right trade, and I’ll win.”

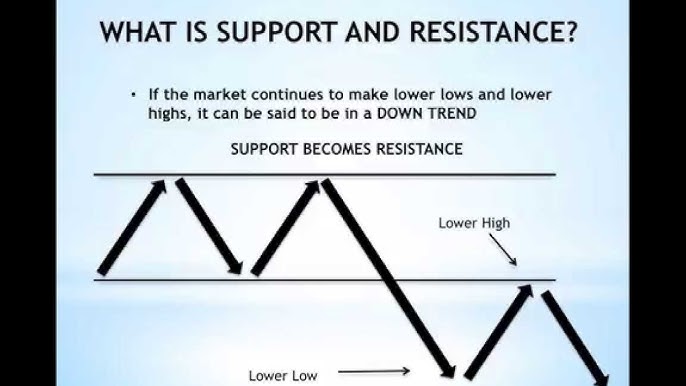

At one point, I only used horizontal support and resistance lines. It worked sometimes, but other times, the market

When I began, I overloaded my charts with every indicator imaginable: RSI, MACD, Bollinger Bands—you name it. I thought

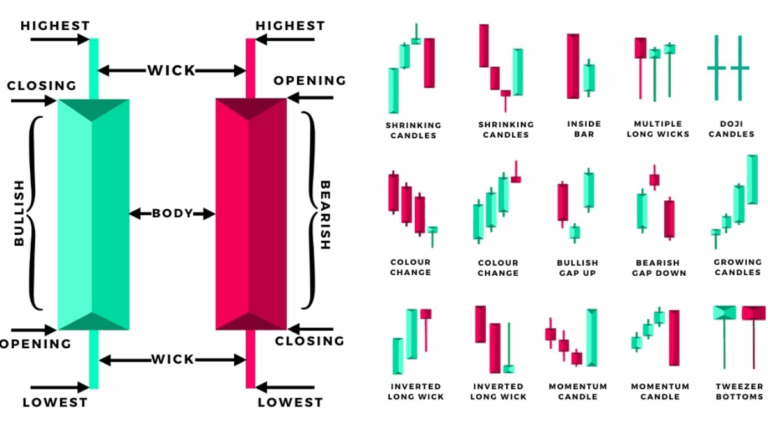

When I first started trading, candlestick patterns felt like a secret code. Everyone kept talking about hammers, dojis, and

When I discovered trading indicators, I went crazy with them. RSI, MACD, Bollinger Bands—you name it, I slapped it

For a long time, I ignored volume. I thought, “Who cares how many people are trading? Price is what

I used to think chart patterns like “head and shoulders” or “triangles” were just gimmicks traders made up. But

When I first looked at candlestick charts, they honestly felt like hieroglyphics. Green bars, red bars, wicks pointing up

When I started trading, I wanted action. I thought being a trader meant constantly buying and selling, making moves

There’s one trade I’ll never forget. I went all-in on a coin because I was convinced it was going

I still remember staring at a chart and wondering why the price kept bouncing at the same level. I

When I first dipped my toes into crypto trading, I thought I was entering a world where everyone doubled

Subscribe to my weekly newsletter. I don’t send any spam email ever!